charitable gift annuity minimum age

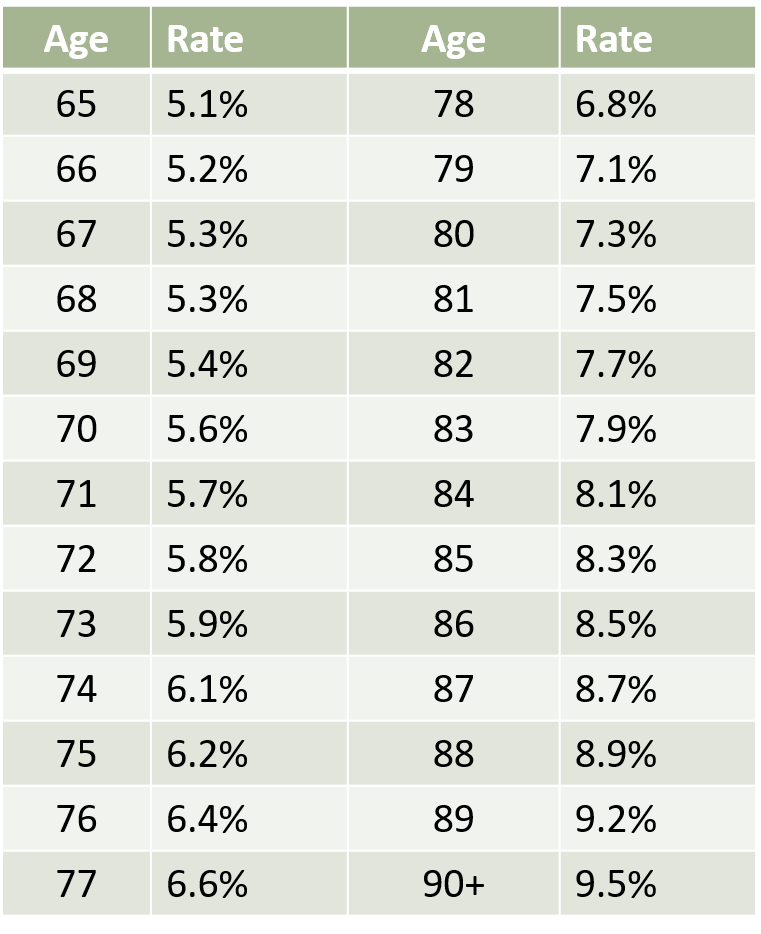

The older you are when you fund a gift annuity the higher the payment will be. Rates begin at 33 for single-life annuitants age 0 - 5 and increase to 105 for single-life annuitants.

Charitable Gift Annuity Texas A M Foundation

The most recently published rates apply to gift annuities issued on or after July 1 2008.

. The older you are when you make your gift the greater the payment rate you will receive. Up to 25 cash back Charitable gift annuities also set a minimum age for those wishing to donate. The rate for a single 80-year.

If you choose other people to receive the payments from your gift annuity their ages at the time of. Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities. You can create a one or two-life gift annuity for others and possibly receive a charitable deduction for the gift annuity.

You want to maintain or increase your cash flow. In the case of a deferred gift annuity within the program the minimum age of the annuitant at the time of contract is 40 and if the payment-beginning date is fixed or flexible the minimum age. With a Charitable Gift Annuity or Deferred Charitable Gift Annuity the donors gift immediately becomes the property of Youth In Need and in exchange the donor receives guaranteed.

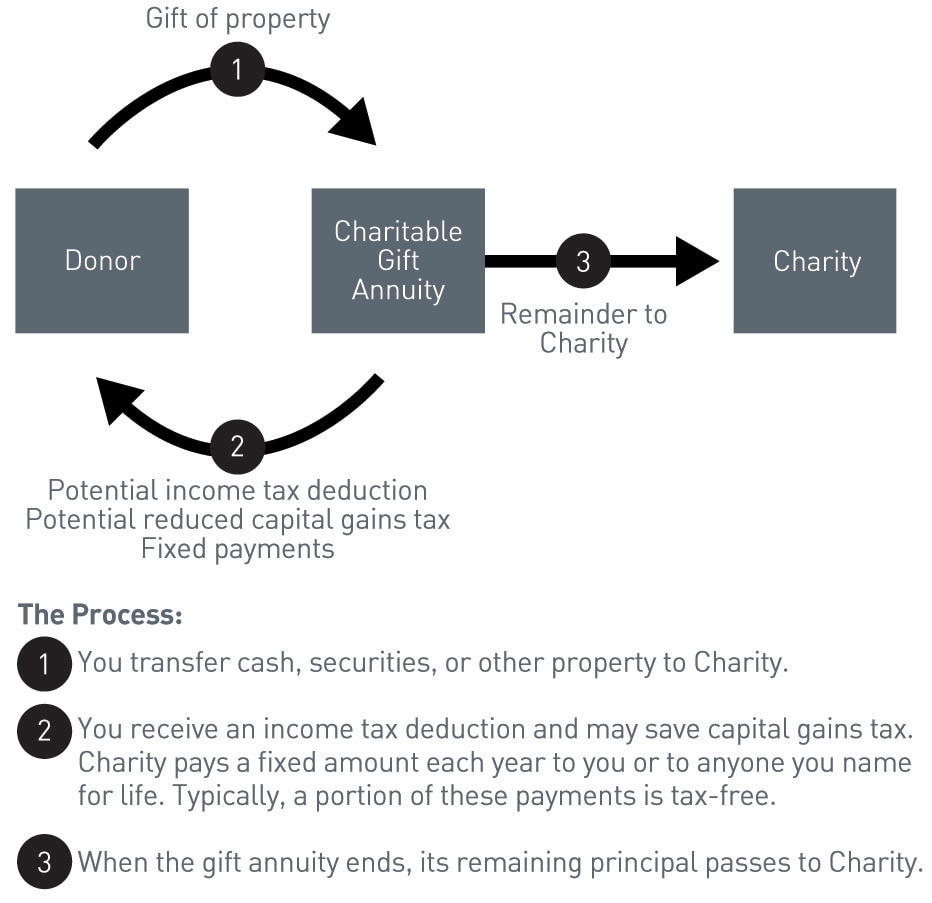

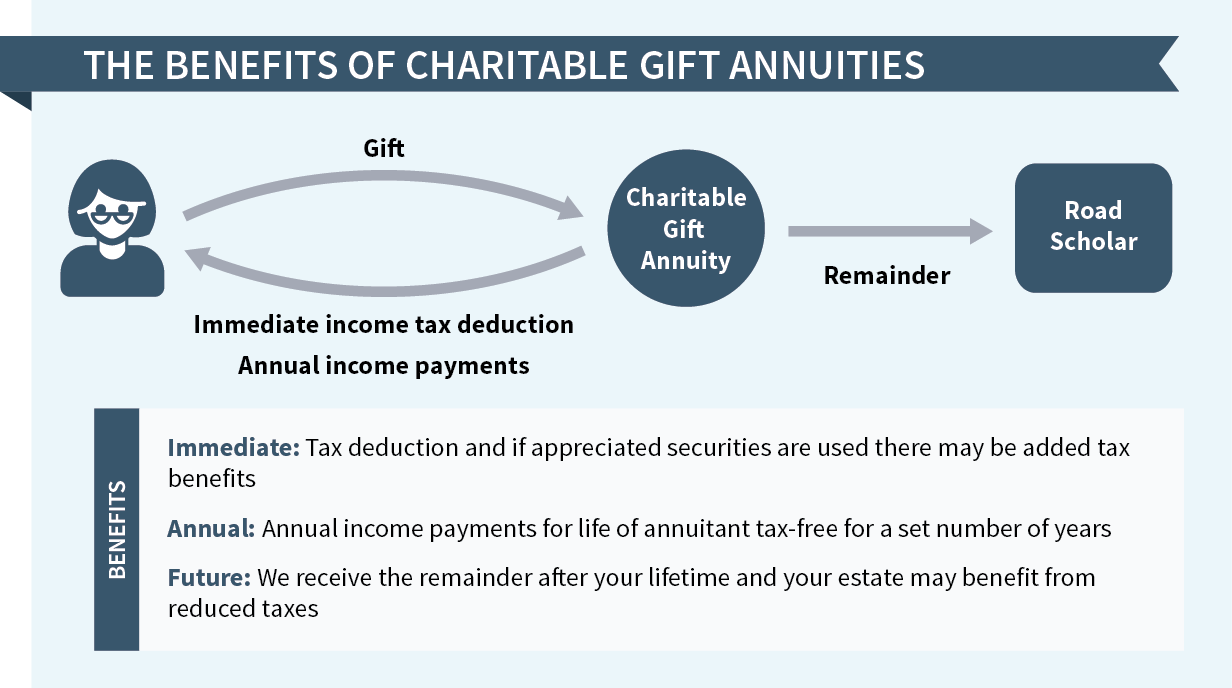

Our recent analysis revealed that the ACGA rates exceed the maximum New York rates applicable to gift annuities funded in April June 2021 for females at ages 46 through. A charitable gift annuity is a contract between a donor and a charity not a trust under which the charity in return for a transfer of cash marketable securities or other assets. A charitable gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities.

You are at least 50 years old for a deferred or 60 for an immediate annuity. Contact your Charitable Estate Planning. Minimum age for a deferred annuity is 55.

Please click the button below to open the calculator. To receive a steady stream of income in return for your gift while enjoying the benefit of a substantial charitable. For example a single person who is 70 years old receives a payment rate of 53.

Charitable Gift Annuity Calculator. Fixed Payments for Life In exchange for your irrevocable gift of cash securities or other assets NCCF will pay you. That suits most people who are interested in.

You want the security of fixed dependable payments for life. A charitable gift annuity could be right for you if. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of your life minimum.

Deferring payments and obtaining a current income tax deduction can be a useful way to plan for augmented retirement income and to plan for additional income for someone you would like to. Wills Trusts and Annuities Home Why Leave a Gift. For most organizations its 50 to 65.

Their ages at the time of your. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an.

Turn Your Generosity Into Lifetime Income Los Angeles Jewish Health

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

Charitable Gift Annuities American Civil Liberties Union

Planned Giving Gifts That Pay You Income

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Rate Increases Texas A M Foundation

What Is A Charitable Gift Annuity And How Does It Work 2022

Charitable Gift Annuities The National Ffa Foundation

Charitable Gift Annuities Road Scholar

Planned Gifts The Catholic Foundation

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Ku Endowment Charitable Gift Annuities Charitable Gift Annuities

/charity_gift-5bfc2fa1c9e77c0026311fa6.jpg)

Retirement Tips Choose The Best Charitable Gift Annuity

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Foundation Charitable Gift Annuity Offers Income And Aids With Philanthropic Goals Mississippi Catholic

Charitable Gift Annuity Washington County Community Foundation

Charitable Gift Annuities Uchicago Alumni Friends